The GFC maintains a close working relationship with the Department of Education (DIP) and banks that offer apprenticeship programmes, in order to identify their needs and provide adequate responses via its Banking Skills Strategic Committee.

Encouraging Excellence

The Geneva Financial Center (GFC) believes that access to highly skilled employees is a central requirement for a competitive financial center. The Foundation consequently supports educational initiatives ranging from apprenticeships to fundamental research, as well as professional and continuing education.

Geneva Financial Center

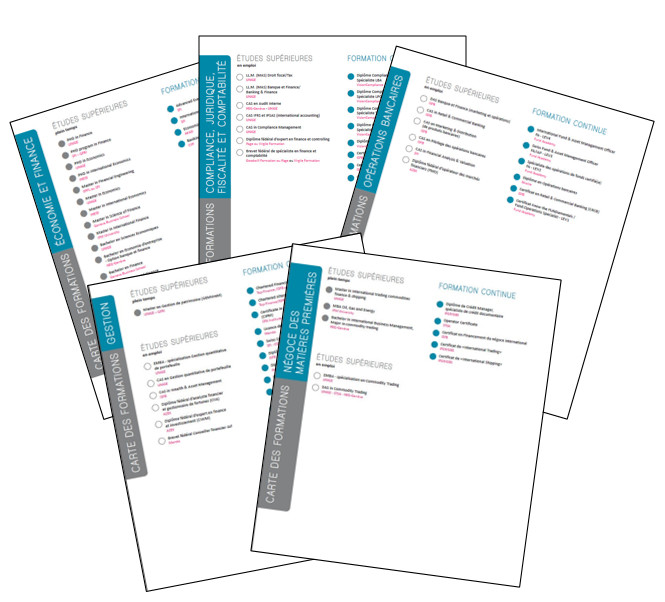

Cartes de formation

Documentation only in French

Le secteur financier offre un univers varié et de multiples opportunités professionnelles. Il n’est pas toujours facile de choisir la filière de formation correspondant à ses envies et au métier envisagé. Afin d’offrir une vision plus claire, la FGPF publie des cartes de formation, selon les thématiques suivantes :

Geneva Financial Center

Attractivity & know-how

The financial sector : creating jobs and value

According to the 2024 Banking Barometer from Swissbanking, 5.2% of all jobs in Switzerland depend on the financial sector. In the case of Geneva, this percentage rises to 10%, making finance a major contributor to the Canton’s economic prosperity. With regard to the distribution of posts by gender in the banking sector, the proportion of women remained stable at 38.4%.

The banking sector is moreover the first industry in Switzerland to offer a customized audit procedure and a quality label for external audit of the pay equity analyses that are required by law. In fact, a centre for pay equity was established in 2020 by the Swiss Bank Employees Association, the Swiss Association of Commercial Employees and the Employers' Association of the Banks in Switzerland because this is a priority issue and a common concern.

For the record, the Equality Act, revised in July 2020, requires enterprises with more than 100 employees not only to perform a pay equity analysis, but also to arrange for an external agency to verify the results obtained. The social partners’ “Specialist Centre on Equal Pay in the Banking Sector” enabled 45 banking institutions representing over 30,000 employees to be audited. The results published by Employers in Banking are encouraging since all the banks adhere to equal pay according to the 5% tolerance permitted by law. Overall, the average “unexplained” pay gap is 4.2%. This is essentially justified by the fact that women have more career breaks than men. Special attention will therefore be paid to a work-life balance.

Geneva Financial Center

Continuing education: active career management

Employees in the banking sector are highly employable. In other words they are able to find a new job, make their own way in the labour market, hold down a position and progress in their careers. In fact, employability largely depends on continuing lifelong education.

According to the Barometer of opportunities and concerns conducted by Employeurs Banques, the bank employers’ association, the main concerns of employees in 2021 were the increased specialisation of the banking professions, the complexity of regulation and the employability of older staff.

Demographic transition in the banking sector, analyzed by BSS Volkswirtschaftliche Beratung, reveals an increase in the average age with a 40% growth in the cohort aged 55-64 years during the last ten years. This study, published in November 2024, was commissioned by the Joint Committee for the Swiss Banking Sector, composed of employer and employee representatives. It found that the employment rate of individuals aged over 50 is still higher in the banking industry than the rate observed in other sectors. It is essential to adopt flexible working models and part-time solutions to maintain this trend. These types of measures help to build on the experience of older staff while supporting a work-life balance. They also help to limit loss of know-how associated with retirement.

The survey emphasizes that with almost one-quarter of those over 55 having taken part in continuing education during the previous month, the banking sector sets itself apart by its commitment to continuing education. This training policy is consistent with the good health reported by staff in this age cohort, with almost 90% stating that they are in good or very good health.

In order promote learning and knowledge transfer within the Swiss financial sector, the Swiss Bankers Association launched the "Swiss Banking Academy" in January 2023, which proposes a wide range of webinars and specialised seminars on fundamentals and hot topics in banking. The content is based on sharing experiences and is strongly geared to being useful in practice. The Swiss Banking Academy is available to all staff of banks in Switzerland and the Swiss financial centre in general.

Geneva Financial Center

How does sustainable finance fit into training & education?

In order to accelerate the banking sector's transition towards sustainability, finance and sustainable development must be integrated into professional, continuing and academic education. This is a sine qua non condition for the Geneva financial centre to remain equal to the challenges and expectations of its clients in this area.

Geneva already benefits from a remarkable offer. In connection with apprenticeship, a major reform came into force in August 2023. The new basic commercial training better integrates the key topic of sustainable development.

In the area of continuing education, the Haute école de gestion de Genève (HEG), in partnership with SSF, and the Institut Supérieur de Formation Bancaire (ISFB) offer certified continuing education courses in sustainable finance. In the field of wealth management, the SAQ CWMA certification, which was introduced in 2017 and represents the benchmark in the industry, has strengthened the sustainability requirements since 2022.

Academic education is not immune to the green wave. In Geneva, the University is committed to this movement with several "Certificate of advanced studies (CAS)" and Masters dedicated to sustainable finance. Finally, the Graduate Institute also aims to train specialists in sustainable finance through a Master in sustainable finance.

Geneva Financial Center

Digitalisation & artificial intelligence

Public-private partnerships for training

In the fintech sector, the “IFZ FinTech” study by the Lucerne University of Applied Sciences and Arts provides a detailed overview of the dynamism of the financial technology market in Switzerland.

At the end of 2024, Switzerland had 483 fintech businesses, with exactly the same number as the previous year. In fact, Geneva ranks third among the world’s most attractive financial centres in the digital context.

Swiss banks have also increased their IT resources in order to transform banking activities. This digitalization is resulting in a transformation of the professions concerned and creating increased demand for continuing education. In order to meet this need, the Geneva School of Business Administration (HEG - Geneva) and the Institute for Studies in Finance and Banking (ISFB) are positioning themselves as key partners. HEG - Geneva awards a “Certificate of Advanced Studies (CAS)” in digital transformation in order to improve leadership in this field and since 2024 has been offering a CAS in Blockchain and Finance, while ISFB has developed a Certificate entitled “Future for Finance” aimed at bank employees. It also offers modular courses in fintech in connection with the regular reviews of the SAQ CWMA certification from which wealth management employees benefit. In 2023, over 92 advisors obtained SAQ CWMA certification in Switzerland. In Geneva, the ISFB awarded 70 certifications and 179 candidates are currently working towards the certification.

Geneva Financial Center

Compliance & regulatory framework

Geneva at the forefront

Geneva is also at the forefront of in-service compliance training, reflecting the shared commitment of the financial and academic sectors. Implemented 20 years ago, the CAS in Compliance awarded by the Centre for Banking and Financial Law at the University of Geneva has become the Swiss standard. It is taught not only in Geneva but also in partnership in Zurich via the University of St Gallen and in Lugano at the Villa Negroni Study Center.

The University of Geneva can therefore be proud that a “Genferei” (a Geneva success story) is being successfully exported today beyond the “Röstigraben” (the dividing line between French and German-speaking Switzerland). This success originates in the promulgation in 1997 and entry into force in the following year of the Anti-Money Laundering Act (AMLA). This law requires not only the client but also the beneficial owner to be identified whenever an account or a management mandate is opened. In order to meet the challenges of this new legislation, the Geneva Financial Center approached the Centre for Banking and Financial Law with a request to develop a training course that was to be as practical as possible. In response, the University of Geneva designed a CAS Compliance in 2003, which very soon became a great success.

This precursor course has been able to adapt to changing regulations. The CAS Compliance initially focused on money laundering, but gradually included the numerous regulatory developments, i.e. mutual assistance in tax matters as well as the prevention of the financing of terrorism and the imposition of international sanctions. This training course therefore also aims to meet the future challenges which Geneva financial operators will have to face. Foremost among them must surely be the new reform of the anti-money laundering arsenal. In order to take account of international developments and the latest assessments of the Swiss measures conducted by the FATF, Swiss money laundering legislation undergoes regular reviews. In May 2024, the Federal Council published its Dispatch on the draft text of a Federal Act on the Transparency of Legal Entities and Identification of the Beneficial Owners, more commonly referred to as the Transparency Act .

In the age of sustainability, compliance in banking is acquiring unprecedented importance. In Switzerland, the Federal Council published a position statement on the prevention of greenwashing in the financial sector on 16 December 2022. At the same time, FINMA initiated a consultation procedure on a new Circular entitled “Nature-related financial risks”. These two examples and numerous international initiatives provide a clear illustration of the profusion of new laws and regulations in the area of sustainability. All these texts will certainly have consequences for compliance, such as the examination of marketing materials and statements made on the subject of sustainability as well as the assessment of the quality of the products on offer that have ESG features. The CAS Compliance will undoubtedly rise to the challenge in assisting practitioners.

Geneva Financial Center

Support for the Geneva Finance Research Institute (GFRI)

The GFC supports the Geneva Finance Research Institute (GFRI), a multidisciplinary institute attached to the University of Geneva which focuses on research and education in finance. It sponsors in particular a year-long "Finance Seminar Series".

In wealth management, academic education plays a key role in training tomorrow’s experts. One of the iconic players in Geneva is the Geneva Institute for Wealth Management, known under the GIWM acronym. GFC is a founding member. This Institute is the result of a shared vision of the Geneva Finance Research Institute (GFRI) and the University of Geneva: to promote a new and advanced university training course in finance and acquire international renown for this tuition, especially in China. In 7 years, the GIWM has helped train nearly 500 students in the wealth management sector.

Geneva Financial Center

Participation in the Board of the Institute for Studies in Finance and Banking (ISFB)

For over 30 years, the ISFB has played a central role in developing essential skills that ensure the Geneva financial center remains competitive. The Geneva Financial Center plays an active part in this process with Christian Skaanild as Chairman and Nicolas Krügle as Vice-Chairman of the ISFB. Jean-François Beausoleil, Hervé Broch and Edouard Cuendet, Director of the GFC, are also board members of the ISFB.

HEG - Geneva and the ISFB concluded a strategic partnership in September 2023 in order to implement from spring 2024 a programme that is unique in French-speaking Switzerland, namely continuing education in banking management, which has been supported by the GFC. This initiative once again demonstrates the relevance of public-private partnerships.

Geneva Financial Center