Political stability, expertise and high-quality training are all factors contributing to the growth of asset management in Switzerland.

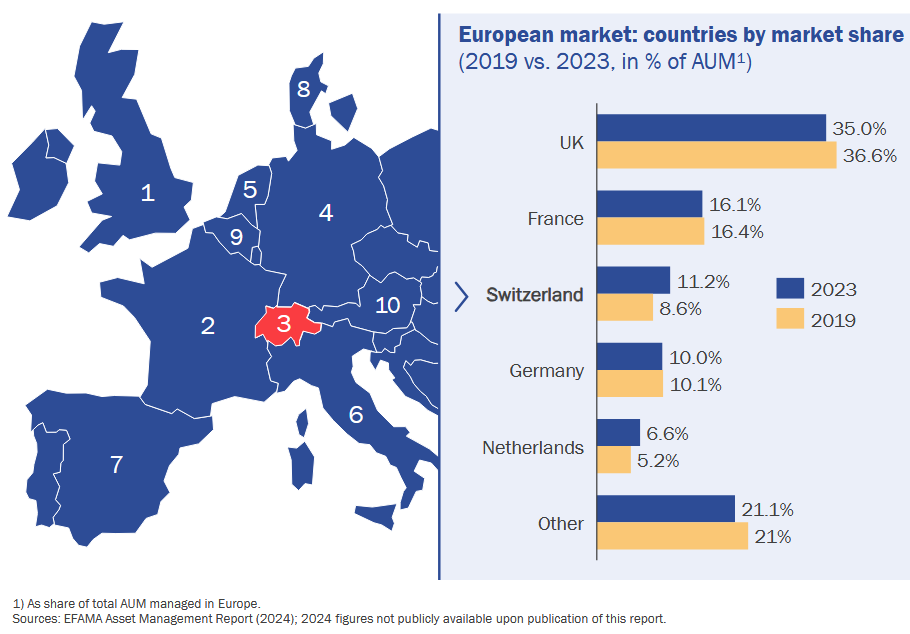

According to the "Swiss Asset Management Study 2025", published by the Asset Management Association Switzerland (AMAS) in collaboration with consulting firm zeb, Switzerland has established itself as the third-largest asset management hub in Europe, with a record CHF 3.45 trillion in assets under management in 2024.

With around 59,800 full-time equivalent jobs directly or indirectly linked to the industry and a contribution of over CHF 700 million in profit taxes to the Swiss economy between 2019 and 2024, asset management remains a central pillar of the Swiss financial center.

Since 2019, the global Asset Management industry has grown by 5% annually. The 2022 downturn has been fully recovered, while consolidation accelerates – the top 10 players now hold 34% of market share (up from 31%) in terms of assets under management.

Despite an annual growth rate of 5% and an improved cost-income-ratio of 69%, the Swiss asset management industry’s overall profitability remains flat. Roughly 90% of net new assets (NNA) comes from market performance, reflecting a saturated market and dependency on global economics. 70% of Swiss asset managers cite strengthening market position as top strategic priority, with product expansion ranking 2nd.

With one-third of managed assets coming from foreign clients, sustainable growth depends on Switzerland’s ability to maintain open, reliable access to global markets.